Disclaimer: The information provided educational and informational purposes only. It should not be construed as financial advice or recommendations for any specific financial situation. The content presented here is based on personal experience, research, and opinions, and should not be considered as a substitute for professional financial advice. Readers should always seek the advice of a qualified financial advisor or consultant before making any financial decisions. The author and publisher assume no responsibility or liability for any errors or omissions in the content, or for any actions taken based on the information provided on this blog. The content may contain affiliate links and ads for which the author earns a commissions.

To the resilient 9-to-5 warriors out there! If you’ve ever felt like you’re wrestling with credit card debt amidst the challenges of daily life, you’re not alone. Fear not, as we embark on a journey to demystify the world of credit card debt, offering tailored strategies to empower you on your quest for financial freedom.

Imagine this blog as your personalized roadmap, designed for the average American grappling with credit card debt while navigating the delicate balance between income and expenses. Join me on this transformative journey as we delve into practical approaches expressed through real-world scenarios.

In the upcoming sections, we’ll not only break down the numbers but also infuse motivation into your debt payoff journey. Whether you’re facing a mountain of debt or seeking to fine-tune your financial strategy, this blog is crafted with you in mind. Together, let’s unveil the secrets of credit card debt, explore effective strategies, and pave the way to a brighter, more secure tomorrow. Buckle up, because your path to financial freedom starts here!

Understanding the Numbers

Embarking on a journey to financial freedom requires a deep dive into the numbers that shape your reality. Picture your finances as a canvas, each brushstroke revealing a clearer picture of your path ahead.

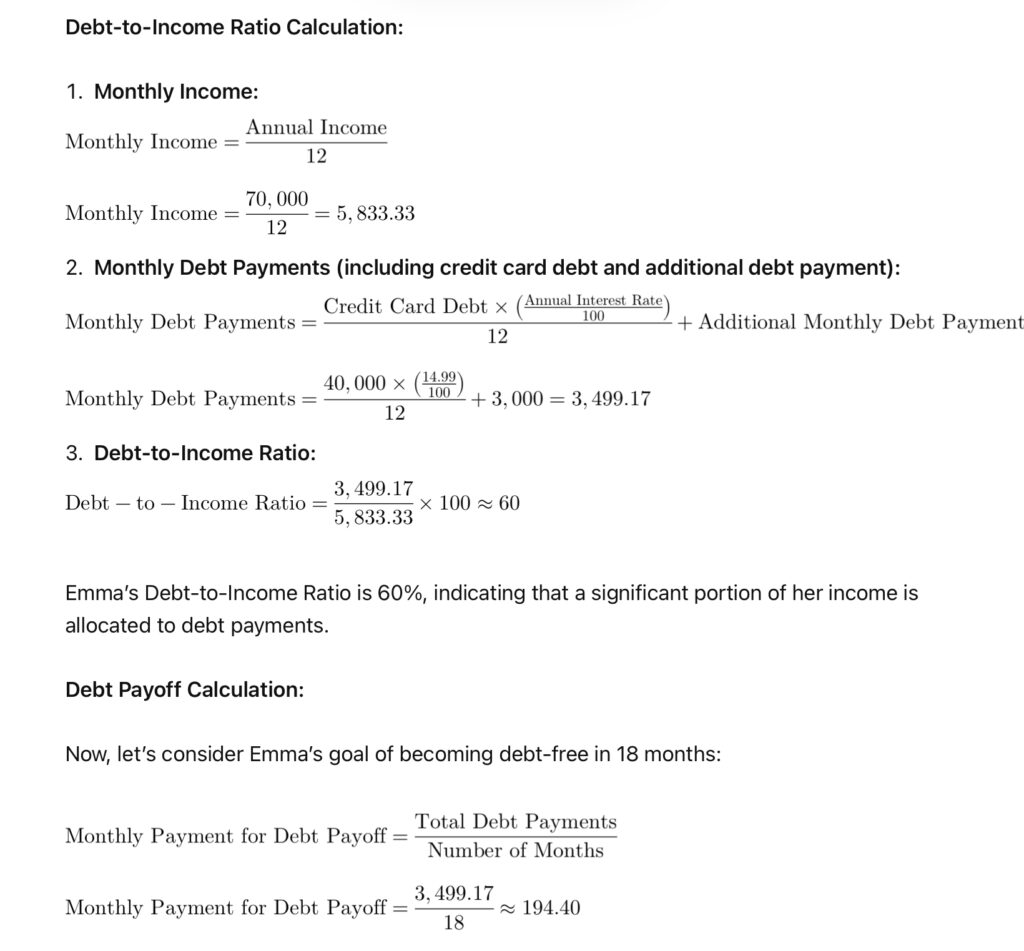

Calculate Your Debt-to-Income Ratio: Take a moment to add up your monthly debt payments. Divide this by your monthly income, uncovering your Debt-to-Income Ratio – a crucial indicator of your financial health. Strive for a ratio below 30%, a threshold ensuring you can manage debt while covering essential living expenses.

Let’s put theory into action with a real-world example. Meet Emma, who finds herself in credit card debt totaling $40,000, carrying an interest rate of 14.99%. Emma’s annual income is $70,000, and the total household annual expenses amount to $55,000 plus an additional other monthly debt payment of $3,000 (for example, student loan debt).

Given:

– Credit Card Debt: $40,000

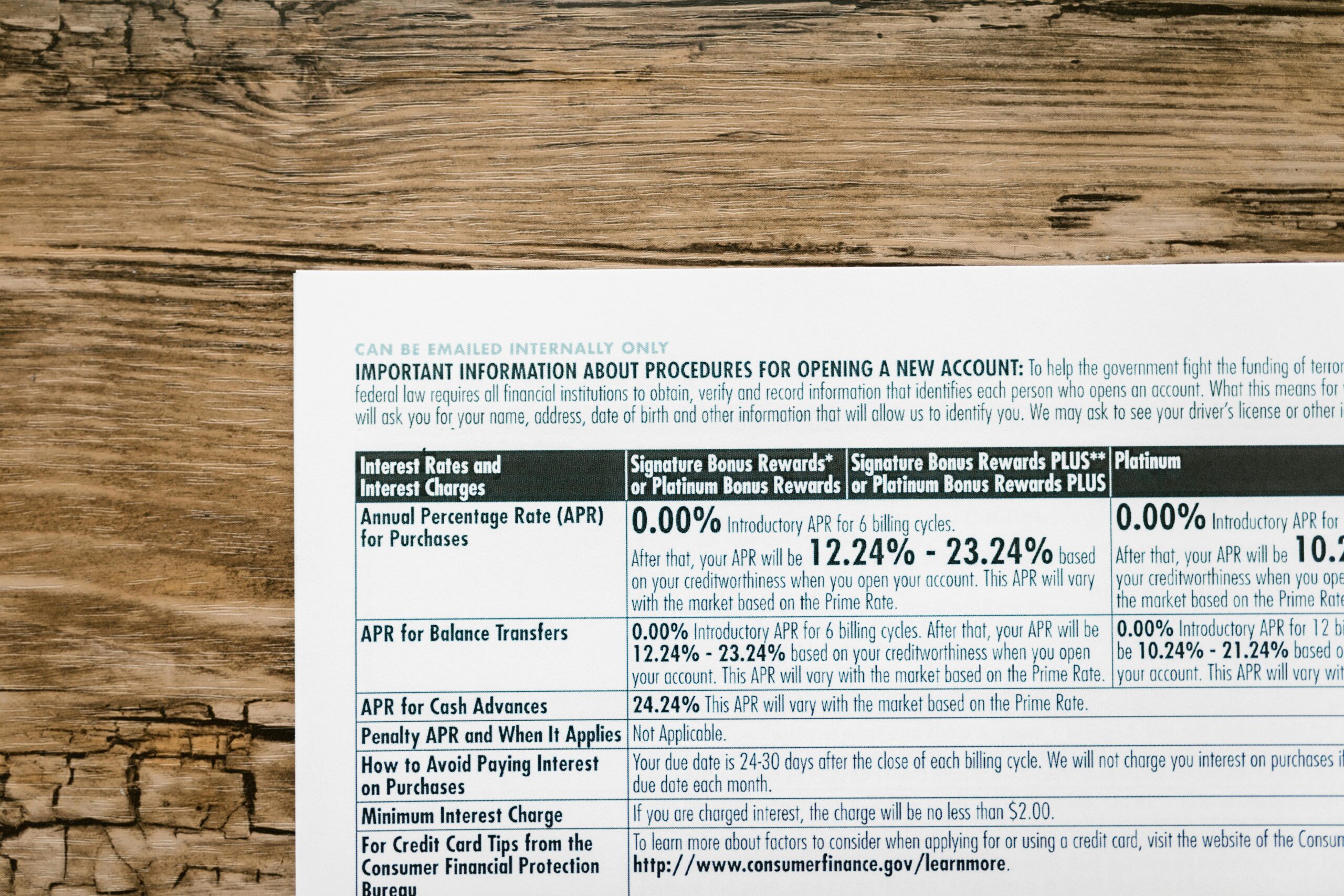

– Interest Rate: 14.99% (the average rate is much higher in our current economy)

– Annual Income: $70,000

– Additional Monthly Debt Payment: $3,000

– Total Household Annual Expenses: $73,000

Emma, to achieve the goal of becoming debt-free in 18 months, needs to allocate approximately $194.40 per month towards debt repayment. This strategic approach minimizes interest paid and accelerates the journey to financial freedom.

While the Debt-to-Income Ratio is currently high, the focus should be on gradually reducing it by making strategic financial decisions and adjustments in spending. Every small step counts towards reclaiming control over finances. Check out our budget toolkit to help you shift your mindset and adjust your finances.

Minimum Payments vs. Snowball Method: Your credit card debts may seem overwhelming, but breaking them down unveils a roadmap to success. Consider the Snowball Method – paying off the smallest balance first. Experience the psychological lift as you conquer smaller debts, building momentum to tackle larger ones.

The Power of Interest Rates: Identify credit cards with the highest interest rates, the silent saboteurs of your financial well-being. Prioritize paying off high-interest debts, envisioning each payment as a step toward liberating yourself from financial burdens.

Practical Expense Management

Budgeting Basics: Transform your approach to finances by meticulously tracking your monthly income and expenses. Categorize spending habits, identifying areas for adjustments. This hands-on budgeting approach empowers you to purposefully direct funds toward debt payoff. Start budgeting today with our budget toolkit.

DO YOU WANT TO SECURE YOUR FINANCIAL FUTURE?

Start with the foundation steps with BUDGETING

Our Budget Toolkit is robust but simplified for everyone to use. Take charge of your finances today. Know where all the money you earn goes and start taking the steps to redirect your hard earned money to work for you and secure your financial future!

Emergency Fund Essentials: Build a fortress of financial security by establishing an emergency fund. Aim for at least three months’ worth of living expenses, creating a safety net to weather life’s uncertainties without relying on credit cards.

Cut Unnecessary Expenses: Conduct a thorough audit of your expenditures, distinguishing between necessities and luxuries. Trim the excess, redirecting funds toward your credit card debt. Each intentional cut is a step closer to financial liberation.

Common Mistakes to Avoid

Ignoring the Numbers: Face the reality of your financial situation head-on. Ignoring debt won’t make it disappear; acknowledging it is the crucial first step toward resolution.

Only Making Minimum Payments: Minimum payments maintain order but won’t significantly reduce your principal. Challenge yourself to contribute more than the minimum, chipping away at the heart of your debt.

Accumulating More Debt: Break the cycle of relying on credit cards for daily expenses. True financial freedom lies in living within your means. Focus on responsible spending and cultivate a lifestyle aligned with your income.

The Debt Payoff Challenge

Ready to Take Control? Here’s Your Challenge: Set a realistic monthly debt payoff goal based on your financial situation. Document your progress, celebrating each small victory along the way. Share your journey on social media using #DebtFreeWarrior, connecting with a community on a similar transformative path.

This journey is not just about numbers; it’s a testament to your resilience and determination. As you navigate the complexities of credit card debt, remember that every intentional step brings you closer to a brighter financial future. You’re not just paying off debt; you’re reclaiming control and rewriting the narrative of your financial story. Embrace the challenge, for in overcoming it, you emerge as a Debt-Free Warrior, victorious and empowered. 💪

DO YOU WANT TO SECURE YOUR FINANCIAL FUTURE?

Start with the foundation steps with BUDGETING

Our Budget Toolkit is robust but simplified for everyone to use. Take charge of your finances today. Know where all the money you earn goes and start taking the steps to redirect your hard earned money to work for you and secure your financial future!